The Philippicae – What Cicero Didn’t See

After the assassination of Julius Caesar, Cicero, a senator who had no love of Caesar, and did not partake in the assassination, turned his attention to attacking the character of Marc Antony. He felt that Antony was just as much a threat as Caesar, and should have also been done away with.

The written attacks became known as “The Philippicae”, or “The Philippics”. They were intended to rally support of the senate against Antony. It worked, and the senate raised an army, declared Antony an enemy of the state, and commenced to do battle with Antony’s forces at Mutina and Forum Gallorum.

Both battles were victories for the senate, but their key generals, Hirtius and Pansa, were killed, and the armies were leaderless and open for acquisition. The local magistrate of Cisalpine Gaul who assumed command, Decimus Brutus, was one of Caesar’s assassins. Octavian (Caesar’s heir), refused to work with him, and the two armies soon switched loyalties to Octavian.

The senate scrambled to bypass Octavian and retake command of the armies. However, always the clever man, Octavian reconciled with Antony, and along with Lepidus, a military general once aligned with the senate, formed the First Triumvirate. This left the senate defenseless.

Cicero, an intelligent man, gifted orator and talented lawyer, had now become open for proscription, along with many other senators and persons of means. He had not necessarily acted without knowing what he was up against, but in the end, even his careful consideration of all matters simply didn’t work out. He was outmaneuvered by Octavian.

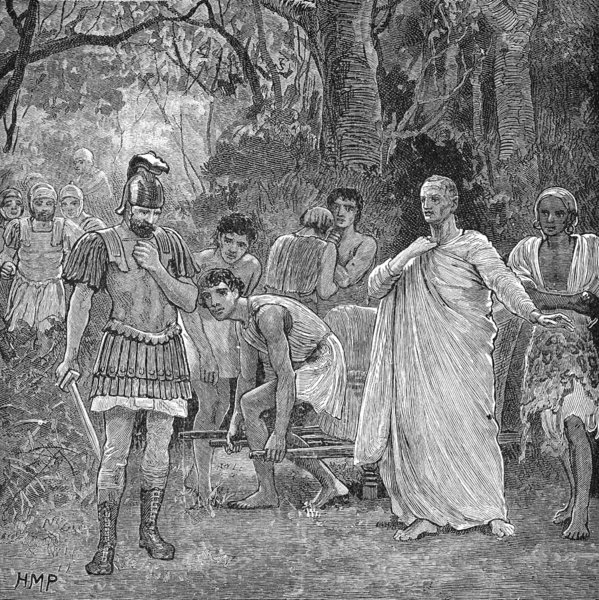

Eventually, Cicero was caught while trying to flee to the coast. He pulled aside his tunic, and offered the arresting legionary his neck, hoping for a swift, painless death. He was decapitated, and his head was staked in the Forum, where patrician nobles took turn stabbing his tongue with pens – a way of expressing their hatred and apparent jealousy for his gifted oratory. His hands were cut off and nailed to the senate house door, as a warning to anyone else who would write against the new triumvirate.

There is a lesson in all that. And it can be boiled down to a simple moral: Don’t take on a fight with an enemy you don’t know well, and especially with a flawed strategy.

But, what was flawed about his strategy? Cicero was not a military commander. He was just a senator, one of many. He didn’t exercise control on the field.

His flawed strategy was not the military conflict, but his instigating the affair with the Philippics, and angering someone (Antony) who still had considerable influence and power with very experienced military units from Caesar’s veteran legions.

Cicero had no such influence on his own, save that via the senate. But, they were not Antony. And soldiers were quicker to follow a military leader they admired, rather than a bunch of bureaucrats they despised.

Cicero had also not judged Octavian’s potential to join Antony, and rally those whom were loyal to his adopted late father (Caesar). He was overpowered and had not the forces to defend himself in such an outcome that had befallen him.

I thank you for your forbearance with this history lesson. I will now make a relevant point with all this.

Last week, the Securities and Exchange Commission filed a complaint in Federal Court against the Meta1 Coin operation, and its principals, Robert Dunlap, et al. Long time RV/GCR talk show host and seminar promoter, Dave Schmidt, was also named in the complaint.

Long ago we warned that the law is clear on publicly offering and selling anything in the form of a security that offers a return on investment. In the U.S., such offerings, unless exempted, require a securities license, or at minimum, registration of the investment. The SEC has now stepped in to make that point with respect to the Meta1 offering.

There are many allegations of wrongdoing in the complaint, and we won’t even try to analyze it here. The courts will eventually decide if the allegations are true or not, and in time we will all know just what Meta1 was doing, and what its fate will ultimately be.

Aside from the main allegations, it was alleged in the complaint that:

“…During the SEC’s underlying investigation of this matter, the SEC subpoenaed each of the Defendants for documents and to appear to testify. Each Defendant returned the subpoena to the SEC with the word “Fraudulent” marked on every page. Schmidt refused to produce documents to the SEC, and refused to testify. Dunlap refused to produce documents. He appeared for testimony, but refused to answer several important questions, such as whether he drafted the Whitepaper, claiming at various times the questions were ridiculous, the answers were none of the SEC’s business, and he “[has] no contract with the SEC.” Bowdler produced some documents, but refused to testify...”

The tactic of marking documents “fraudulent”, especially under these circumstances, and claiming that one “has no contract with the SEC”, or other government agency, under such similar circumstances, is often used by persons who take the position that they are “sovereign” or somehow not subject to the jurisdiction of the law because they are now a “secured party creditor” or some such thing.

The courts have repeatedly rejected the claims of people using such arguments, and those who have persisted in using such claims to prevail in a legal case have found themselves either fined for doing so, or jailed after being convicted for crimes when such defenses failed.

As we saw with Cicero, even the best thought-out plans can wither against the unknown and unpredictable. But, it is made even harder when you outright ignore, or blissfully act in ignorance of your opponent’s track record of victory against a tactic you are trying to use in defense. Further, you make yourself a wider target for doing so.

The government considers any use of fraudulent sovereignty claims against their jurisdiction as a sort of Philippic against them, and once you bring such claims onto the battlefield, you are at once in a very precarious position, with almost no defense. The ram has now touched the wall. And, when the opponent is the SEC, there is serious power behind that ram. And claiming that your opponent does not even have a right to ram your wall, after they have, is not going to scare them away, or rebuild the wall.

We will certainly watch with great interest how this case turns out. There are larger issues at stake within this case, but we will leave that for another time.

Moving on…

The adoption and innovation in the digital asset realm continues, and with increasing interest and demand. There is tremendous value all around at this time. Be sure, the buying windows for many of the new up and coming ideas will not last forever.

The upcoming BTC halving and continuing Wall St and other interest in this sector is queuing up to create a potential explosion in value that could be unprecedented. Big interests, exceeding several trillion dollars in combined worth, are continuing to invest in and develop in this sector.

I learned from many years of experience that wealth is best acquired by investing in value, and holding on through any and all volatility, comments, opinions, reasons to vary from that approach. By combining the patience of an investor and the boldness of a speculator, and becoming an “investolator”, you can benefit from such an approach without losing sleep, getting ulcers, betting on chart patterns, reading chicken bones in a bowl, spitting Bacardi on your wife, or wondering which Youtube “analyst” with unknown credentials is the right guru to follow.

Simply locate value, take a reasonable position size based on your personal risk capital, and hold it. Value will create demand. And in this sector, that demand, combined with declining availability in BTC, (which is currently a liquidity reserve that most other alt coins transact in and out of) will force an effect on price. But, timing is critical. Getting in early, ahead of the halving and large capital influx, may have a tremendous affect on the potential future gain.

The last two times the BTC code mandated a halving, many coins experienced severely irrational gains in appreciation. Spectrecoin, Reddcoin and Verge, for example, handed investors profits of $2,000,000, $2,700,000 and $5,000,000 for every $500 ventured. And this was before the kind of significant commercial interests we now see coming into this space.

Similar gains were had with NEO and Ethereum. There were many who saw what was coming, quietly bought and waited, and made millions. Others dithered, questioned, nit-picked over “flaws”, over-analyzed charts, engaged in Pavlovian peer-enforced skepticism, or simply just didn’t know.

Will such gains happen again? I don’t know, but I would guess that the chances are probably better now than they have ever been in the past. Always keep in mind that, at this time, it is not necessary to take huge risks to make potentially huge gains. So, for what I would spend over a weekend in Vegas, I can instead place such resources into something that no slot machine can probably return.

The key is picking good projects. This is where your job to do good homework and research comes into play. There are many resources out there to help you do this, so find one you find agreeable, and stake your claim if you so choose.

In the event that public RV paper exits fail, you now have a hedge, with low buy-ins, should you choose to partake. One that has come along at the right time and probably stands a much better chance than paper returns might. We had always hoped that people could exit their paper before the anticipated run-up in the digital asset markets. But, time is running out for such preferred sequences to take place.

At present, our understanding of what we watch for is as follows:

The Global Settlements remain un-settled. Do not be surprised if such remains so throughout 2020. The opposing party obviously do not fear legal repercussions. Even in these trying times, when the industrial might of our land has come to a near halt, these money-changing, hobnail-toed parasitical vermin refuse to release what is not theirs; depriving the nation of much needed revenue to cope, in a truly sublime display of their contempt for the general welfare.

We continue to watch for private group transactions and the attendant Brontosaur-sized turds that they will deposit once they transact – including any possible public transactions. While we cannot detail such, the groups will proceed first before any public chances can materialize.

If you are in a legit group, continue to maintain silence and obey all admonitions to you concerning confidentiality. Failure to do so could be costly. We understand that legitimate groups are making good progress. However, details simply are not possible to share openly at this time.

With the current epidemiological hysteria, there are some who are convinced that this “crisis” will be used to implement central bank digital currencies. The legal language describing digital wallets/digital dollars in the latest US stimulus bill is intriguing, so the notion of some new form of monetary infrastructure being enabled is perhaps a viable possibility. What this has to do with anything we watch for is still not clear. However, it is interesting to think that releases which parallel the general stimulus payments would probably go unnoticed in form, but the results would be “expected” in such a case and less of a “surprise” if released solely without a public stimulus at the same time. We will see.

The death rate from the current viral outbreak is terrible, but still far less than other natural killers. Remember the tsunami of 2004? It killed c230,000 people in one afternoon. A similar event directed at either of the U.S. coasts would kill millions, and send our economy into a tailspin that would take years to recover from.

Many were not prepared for this recent, rather mild breakout; a love tap compared to what could happen in the future. How prepared do you think most are for a real natural event, one that really has a punch to it?

Earthquakes, volcanic eruptions, storms, diseases, meteor impacts, terrorist originated biological attacks, etc. Are you ready for such?

As long as we continue to manage the earth with politics and money, we will be left wide open to allowing the least qualified persons to prepare for or manage such events, so you better be self-sufficient.

Always be ready for anything. That way, if you are wrong in your predictions, you can still be right.

We are still waiting for WHR #48 part two. We will post it when ready.

Get ready for a wild ride for the rest of 2020.

WHA

You’ve got to expect things are going to go wrong. And we always need to prepare ourselves for handling the unexpected. – Neil Armstrong

Leave a reply to Martin Cancel reply